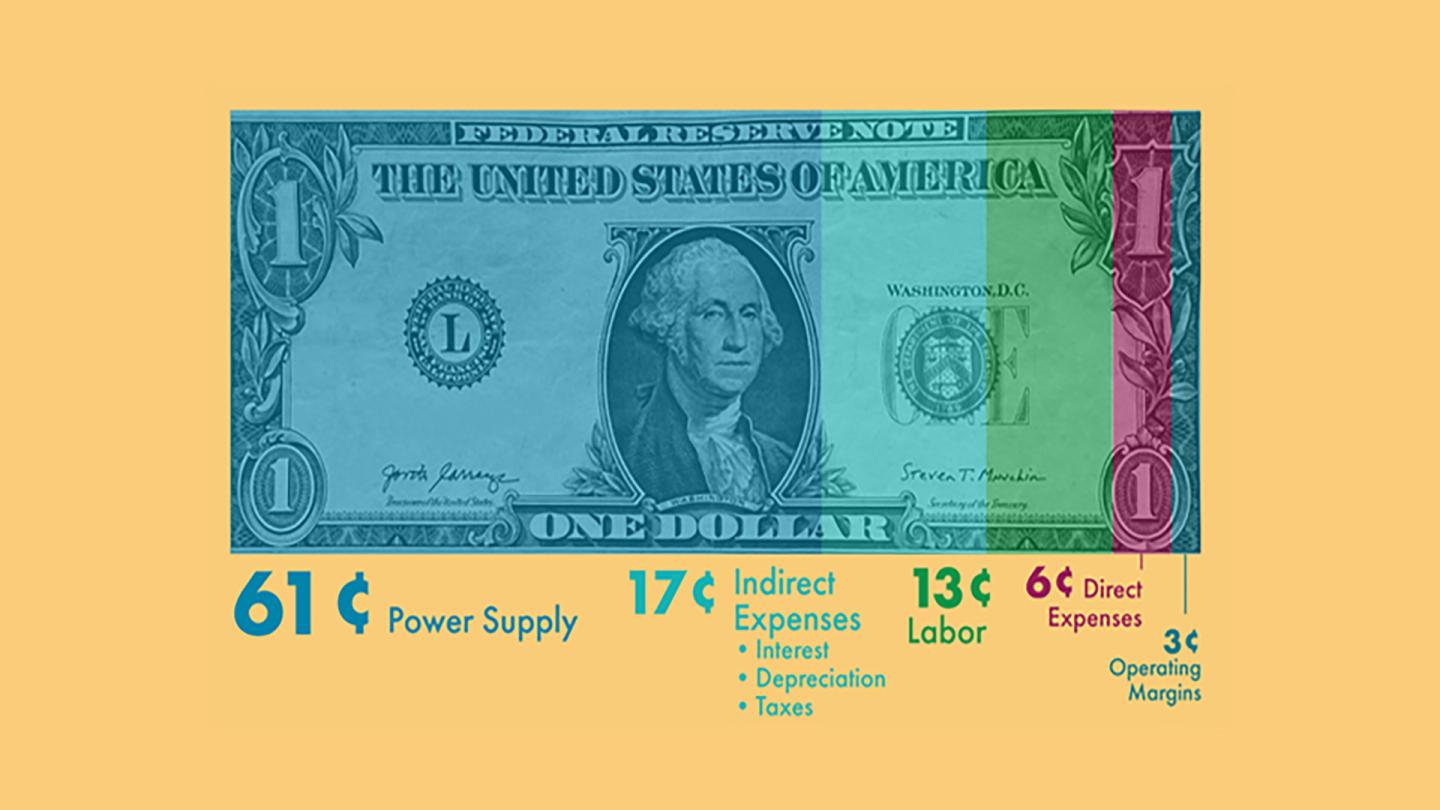

INDIRECT EXPENSES

Indirect expenses comprise 17 cents of each energy dollar. These are expenses that Sioux Valley Energy has no control over and include depreciation, interest, and taxes.

The business of providing electric service to members is a very capital-intensive industry – as an example, the average cost to construct just one mile of three-phase underground electric line is $210,000. To put that in perspective, Sioux Valley Energy owns over 6,200 miles of line on its system.

Electric cooperatives, like Sioux Valley Energy, utilize long-term loans to finance the construction of the electric grid (capital projects). That strategy helps to spread costs over time and ensures that the infrastructure that typically lasts 30-plus years is paid for by all the members who will use it – past, current, and future.

LABOR

As with any business, there is a cost to labor including wages and benefits. For Sioux Valley Energy, 13 cents of each energy dollar pays for labor. The Cooperative employs 115 individuals who fill essential roles in operations, engineering, technology, dispatching, finance and accounting, billing, administrative services, public relations, safety, human resources, member services, beneficial electrification, and strategic leadership.

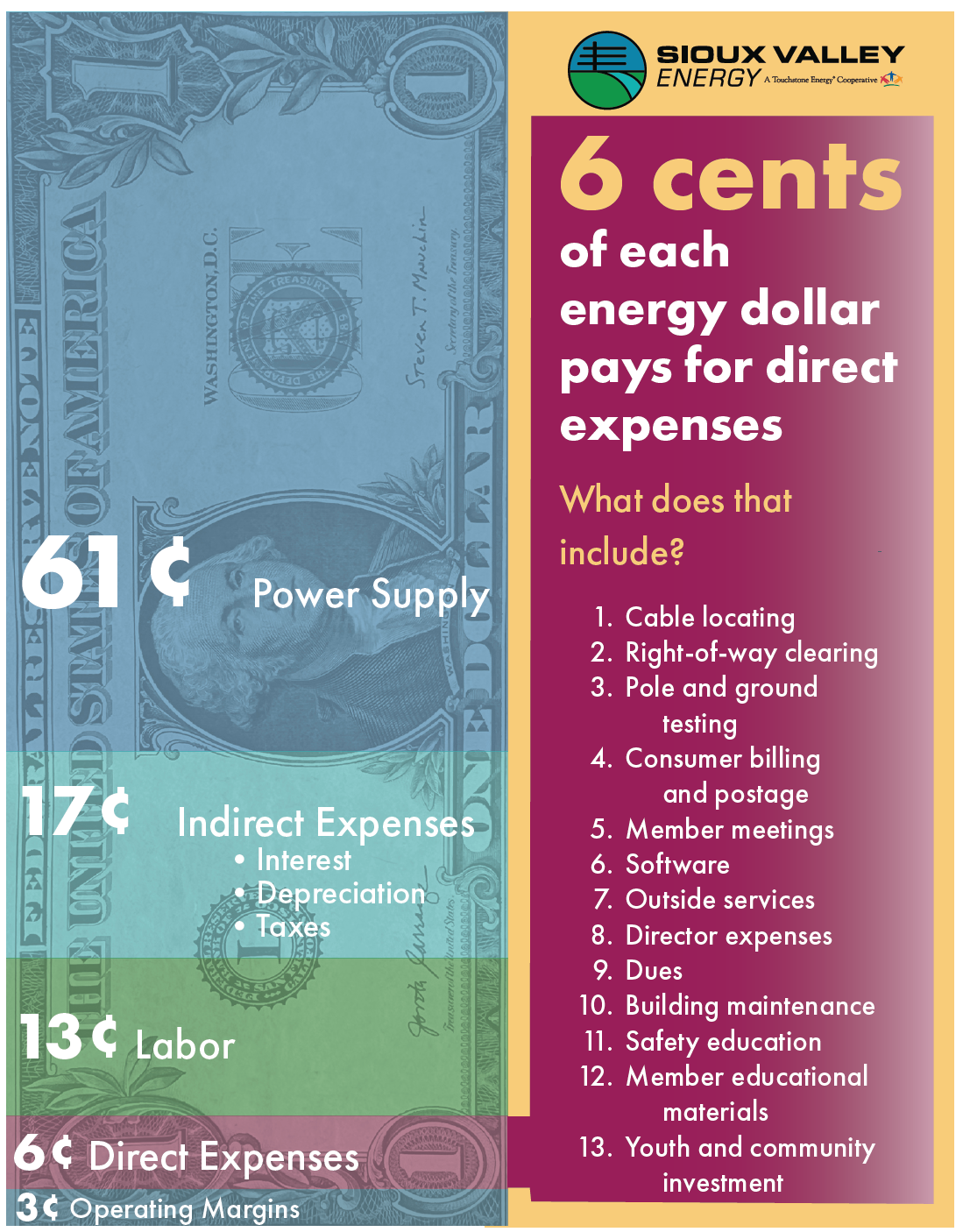

DIRECT EXPENSES

Just six cents of each energy dollar is utilized for direct expenses. These are the expenses that are controllable. However, significant cuts in these areas would impact the exceptional service you have come to expect from the Cooperative. What services and expenses are included in direct expenses? The most significant costs in this area are cable locating, right-of-way clearing, and pole and ground testing. All of these services play a major part in both safety and reliability. Other expenses under this category include consumer billing and postage, member meetings, software, outside services, director expenses, dues, building maintenance, safety education, member educational materials, and youth and community investment.

OPERATING MARGIN

Sioux Valley Energy budgets three cents towards its operating margins. This allocation is needed to meet the Cooperative’s lender requirements. And while the operating margins are collected in the rates you pay and reinvested back into the system – those dollars are eventually returned to the membership in the form of capital credit retirements.